Tags

risk insurance contracts indemnification lawsuit risk managment claims risk control risk avoidance cannabis insurance marijuana insurance business insurance risk identification hold harmless risk transfer

Latest Knowledge Board posts

Biography

Since 2009, Greenpoint Insurance Advisors, LLC has provided commercial insurance, risk identification, and solutions to hundreds of cannabis retailers, cultivators, and manufacturers within regulated markets. This experience has allowed JB Woods to witness why certain cannabis companies either succeed or fail. Typically, the latter has nothing to do with insurance. But rather, a lack of understanding by the organization and its members to understand the nature of risk particularly in the cannabis industry.

The types of risk a cannabis operation is likely to encounter include many of the following:

- Adminstrative and Agency Risk

- Compliance: Going Above and Beyond

- Employee

- Risk with signing contracts and agreements

- Product Liability from cannabis and its derivatives particularly as a manufacturer

- Fortuitous: theft, fires, and employee injuries

- Protecting Your Reputation

- Partnerships can be either an asset or liability

- Investors

- Mergers/Acquisitions

- Corporate Governance

- Corporate Structure

- Insurance: Are you prepared to do business with a cannabis insurance company?

- Ancillary Companies and Independent Contractors: Are you assuming their risk?

- Other

We hope to provide you with the assistance necessary to avoid or control certain risks in this wonderful industry.

Warm Regards,

DISCLAIMER: We are not licensed in all states. This information is not meant to induce or solicit new insurance clients and should not be construed as such.

Please visit our website and terms of use for further information.

Experience

President

Greenpoint Insurance Advisors, LLC

July 2009 - present

President and Founder of Colorado based Greenpoint Insurance Advisors, LLC

Other

Publications

More on the cover story: Marijuana businesses can get insurance, but it's pricey

Denver Business Journal

Insurance Giant’s Exit From Cannabis Market Could Trigger Shakeup, Higher Rates

Marijuana Business Daily

Hello:

Thank you for your good, but difficult question to answer due to a dynamic marketplace exist with insurance. The cannabis insurance industry can be rather volatile and subject to change. For example and most recently, Evanston Insurance Company has decided to exit the cannabis industry.

These numbers are approximately based on line of business insurance:

Commercial Liability and Property: 8 to 10 Insurance Carriers

Product Liaibility: 3 to 5 Insurance Carriers

Directors and Officers: 2 to maybe 3 Insurance Carriers

Professional Liability: 2 to maybe 3 insurance Carriers

Other--EPLI, Cyber, IP, Professional, Etc..: 1 to 2 Insurance Carriers

Workers Compensation: Each state has their own requirements. But, outside of assigned risks pools maybe 2 Insurance Carriers

Commercial Automobile: 1 o 2 Insurance Carriers

As you can see, the number of insurance carriers for commercial liability and property are higher in number as opposed to more specialized types of products such as D&O. The greater number of insurance carriers offering a line of coverage typically means the risk is more acceptable as opposed to the other lines of coverage where risk is considered to be greater.

Thank you for the question

JB Woods

Greenpoint Insurance Advisors, LLC

I believe this is positive for the industry, invite competition and good for public policy. The biggest change will be licensed retail insurance brokers will be required to quote Golden Bear or any other admitted carrier that enters this space, due to insurance regulatory requirements known as an "Diligent Search Report." They can no longer just offer a surplus lines or excess insurance policy without going through this process.

California retail insurance brokers will want to find access to Golden Bears distribution channel most likely a subsidiary they own to to offer this admitted program.

The greatest impact will be on the Surplus Lines Brokers in California. If more admitted insurance carriers enter the California market which I'm predicting, I don't see how these carriers will continue to offer cannabis insurance.

What has been the impact of the exit of Lloyd's of London from the cannabis industry?

It has been one year since Lloyd’s of London exited the cannabis industry, can you speak to the impact, if any, that has made on the industry?

Hi Hieu:

Great question!

The first point to realize is a small number of insurance carriers offer specific coverage to the cannabis industry. When Lloyds of London vacated, I believe their exit created turmoil within the insurance industry as other carriers carefully evaluated their level of interest to continue or by ltakig action to limit coverage to this segment.

Furthermore, Lloyds of London was a viable marketplace to insure certain types of cannabis companies such as ancillary businesses that other insurance carriers would not cover. I believe ancillary companies were hardest hit by the Lloyds departure.

For cannabis licensees (dispensary, cultivation, and infused products manufacturers) certain lines of insurance such as general liability and property are offered by several companies and more readily available. For those seeking product liability, directors & officers, employment practice liability, and professional liability, the cannabis insurance market is quite limited.

Lastly, a comprehensive cannabis insurance program is available today that entered the marketplace when Lloyds of London exited. I'm hoping more insurance carriers will realize the tremendous opportunity that exists in the cannabis industry particularly when companies such as Microsoft have conducted their own due diligence as cited below.

Thanks for the question.

In what areas could a cannabis business get surprised about insurance policy lack of coverage?

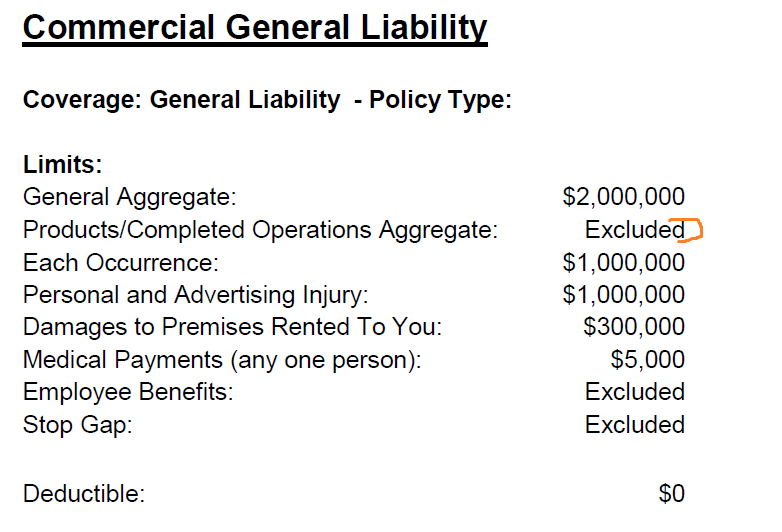

Thank you for your question on areas a cannabis business may be surprised no coverage exists. Most cannabis commercial insurance policies exclude "products and completed operations" or product liability depending the individual circumstances. Essentially this means the cannabis and cannabis related products manufactured and distributed into the stream of commerce may result in liability from a third party with coverage not provided.

For example, a customer becomes sick from an edible or driving under the influence results in a car accident. In either example, the possibility exists the cannabis licensee may be the target for collecting financial damages such as medical, property damage, personal injury, and legal expense.

This is one example of a coverage that may be excluded or "surprise." There can be other surprises and depends on the needs of the cannabis licenses and competence level of the insurance broker. As such, we recommend the cannabi business evaluate their individual circumstances with an experience licensed brokers in their state of operation.

Product liabilty or Products and Completed Operation Exclusion (Sample Document):