Treasurer Chiang Releases Recommendations to Address Lack of Banking for Cannabis Industry

PR17:59

Nov. 7, 2017

Contact: Marc Lifsher

news@sto.ca.gov

916-653-2995

SACRAMENTO – State Treasurer John Chiang today released a report outlining steps California can take to address the lack of banking services that force much of the cannabis industry to operate in cash.

“It is unfair and a public safety risk to require a legal industry to haul duffle bags of cash to pay taxes, employees and utility bills,” said Chiang. “The reliance on cash paints a target on the back of cannabis operators and makes them and the general public vulnerable to violence and organized crime.”

The Treasurer’s report comes two months before California begins a new era by legalizing the commercial sale of recreational cannabis on January 1, 2018. Voters overwhelmingly sanctioned this new industry in 2016 when they passed Proposition 64.

Legalizing adult-use cannabis is projected to generate annual sales exceeding $7 billion and an estimated $1 billion a year in tax revenues.

The findings in the detailed study released Tuesday were distilled from six public hearings of the Treasurer’s 18-person Cannabis Banking Working Group, whose members included representatives from local and stat...more

How Much is your Cannabis Plant Worth According to your Insurance Carrier?

Golden Bear Insurance Company Using Per Cannabis Plant Valuation for Crop Insurance

by

Greenpoint Insurance Advisors, LLC

Filed with the California Department of Insurance, the first admitted cannabis insurance carrier Golden Bear Insurance Co is using a per plant valuation to calculate how much will be paid should a claim occur. For example, a fire burns 200 cannabis plants considered "Flowering Plants," then $150 per plant or $30,000 would be paid for this type of claim according to the policy forms filed with the Department of Insurance. A mother plant will pay $800 per plant if you have a covered loss.

This is a unique approach we have not seen before with other cannabis crop insurance carriers. Keep in mind, there have been only two carriers offering this type of coverage. Historically, other crop insurance policies would base the settlement on either a replacement cost or actual cash value depending on the carrier. Determining the right value using replacement cost or actual cash value is tricky due to factors such as market conditions, genetics, and demand for certain strains of cannabis.&...more

First Admitted Marijuana Insurance Carrier in the Nation Approved in California to Sell Pot Coverage

Golden Bear Insurance Co. will likely take a Big Bite out of Existing Non-Admitted Insurance Markets

Well, it finally happened with Golden Bear Insurance Company was approved by the California Department of insurance to offer coverage through an admitted insurance program for marijuana companies. This is a really big deal for those of us who specialize in marijuana insurance because historically, this line of insurance was offered only from "non-admitted carriers" specializing in "high" risk. This will be a bigger deal to the marijuana industry as they begin to benefit from either better pricing, coverage availability, and friendlier claims practices.

The primary difference between admitted versus non-admitted carriers is admitted are approved by the Department of Insurance through what is known as a rate filing. This means their policy forms, underwriting, and pricing are reviewed by a regulatory agency before approved and offered to the public. The non-admitted insurance market avoids this approval process leaving the cannabis business with fewer options.

According to our sources, Golden Be...more

New Website Announcement!

ORION GROUP NYC is pleased to annouce that our website has been fully revised and updated to reflect our focus on compliant cannabis banking and payment solutions.

CHECK IT OUT!

www.oriongroup.nyc

...more

Essential Stewards of Commerce

Due to the perception of (as opposed to actual and practical) risk of banking the cannabis industry largely based upon misinformation or a deliberate lack of information as well as ingrained prejudice against marijuana, US financial institutions are nearly universally unwilling to open accounts or provide basic banking service to marijuana-related businesses (MRBs) or ancillaries who provide services to them.

As a result, except for a lucky few most are either obliged to operate entirely in cash, or seek a ‘covert’ (some would say fraudulent) checking account, merchant processing, ‘cashless ATM’ or ‘electronic wallet’ workaround under an innocuous guise, i.e., a flower shop or consulting company and expect to have their account closed and be obliged to find an alternative solution 3x-4x a year.

Banks’ reckless disregard of their responsibility in the financial system as ‘essential stewards of commerce’ additionally has the consequence of flooding communities with billions in untracked cash serving to incubate and encourage violent and organized crime, injury to innocent bystanders, tax evasion, money laundering, inadequate compliance and shady accounting.

ORION GROUP NYC is bu...more

Insurance Carriers Needing Assistance with Due Diligence Process for Offering Cannabis Coverage

With California around the corner, there are many insurance carriers contemplating or conducting analysis if they should start offering cannabis insurance to this fast growing industry. These insurance carriers might be admitted or non-admitted insurance companies seeking valid and credible information with structuring a cannabis insurance program through the right partners.

Insurance company executives, attorneys, actuaries, or other parties representing their respective interests actively conducting due diligence may want to contact us through the Expert Calling Network for a confidential consultation. Greenpoint Insurance Advisors, LLC is a retail insurance broker specializing in cannabis insurance since 2009. We've worked with hundreds of licensees in the areas of insurance procurement and risk management.

Important considerations if you're an insurance carrier:

- What types of risk should the insurance carrier consider?

- What product distribution channels should I use or avoid?

- Coverage analysis

- Other variables to consider known and unknown

- Contractual forms considerations

- Exposure analysis: liability, propert

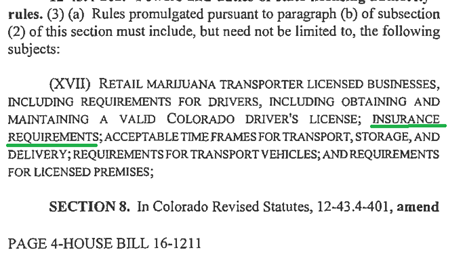

Insurance Requirements for Medical and Recreational Marijuana Transporter

Colorado Law Now Requires Marijuana Transporters be Licensed to Move Product

©2017 Greenpoint Insurance Advisors, LLCRecently, Colorado House Bill 16-1211 was signed into law requiring medical and recreational marijuana transporters to hold a state issued licensed. Using company vehicles, these businesses provide transportation of cannabis product from licensees and may offer the ability to store product at their business location or distribution point.

Colorado House Bill 16-1211 Marijuana Transporter Insurance[/caption]As a condition of their license, a transporter must have insurance. The law is silent as to the type of insurance, but in our opinion the purchase of commercial automobile insurance would be a minimum requirement with possibly commercial liability and property insurance particularly if the licensee maintains a storage or distribution facility.

A question that should be raised is how will the cannabis product be insured or covered during transportation or storage? This will be a difficult issue to address through insurance as carriers offering commercial automobile or business property have avoided insuring the property of others when ...more