Crop Insurance for Cannabis Grown Outdoors Now Available

In the history of cannabis insurance there has never been a insurance company willing to offer coverage for cannabis plants growing outside. Think about it, the chances of something going wrong due to weather or criminals seeking an easy target had scared off most insurance companies. Indoor crop insurance has been available from approximately two companies knowing those plants are protected by four walls, video, alarms, and gated windows.

However, the thought of offering outdoor crop insurance was unheard of until now.

The insurance industry is conservative my nature. The availability of outdoor crop insurance is considered a giant leap forward for both the cannabis and insurance industry. There are many variables analyzed by actuaries attempting to quantify if a program of this nature will be viable long term. Those variables include understanding the numerous hail storms that occur in Colorado. That California is subjected to many wild fires. Washington State can experience flooding and wind damage. Knowing an insurance company analyzed these types of risk was the last frontier in cannabis insurance to be conquer...more

Cannasure and Next Wave Insurance Collaborate on Cannabis Insurance White Papers

National Cannabis Industry Association Forms Insurance Sector Committee

Two cannabis Surplus Lines Brokers Cannasure and Next Wave Insurance have formed a committee to change the cannabis insurance industry courtesy of the National Cannabis Industry Association ("NCIA"). For NCIA members and non-members, the NCIA offers several committees involving industry experts on a variety of topics. As such, a committee to tackle and parse through the myriad of issues associated with insuring cannabis made up of lawyers and insurance professionals.

The chairperson is Cannasure's very own Mr. Patrick McManamon with Mr. Ian Stewart, Esq. as its vice chairperson from the law firm of Wilson Elser. The committee has two members from Next Wave Insurance, Mr. Michael Aberle and Mr. Jeff Ward to be certain they are properly represented.

The first committee of its type appears mandated to discuss risk management, insurance coverage issues, and deciding where the next lawsuit will arise involving insurance. Cannasure and Next Wave Insurance are both licensed surplus lines brokers that operate throughout the United States appointing insurance brokers...more

How Much is your Cannabis Plant Worth According to your Insurance Carrier?

Golden Bear Insurance Company Using Per Cannabis Plant Valuation for Crop Insurance

by

Greenpoint Insurance Advisors, LLC

Filed with the California Department of Insurance, the first admitted cannabis insurance carrier Golden Bear Insurance Co is using a per plant valuation to calculate how much will be paid should a claim occur. For example, a fire burns 200 cannabis plants considered "Flowering Plants," then $150 per plant or $30,000 would be paid for this type of claim according to the policy forms filed with the Department of Insurance. A mother plant will pay $800 per plant if you have a covered loss.

This is a unique approach we have not seen before with other cannabis crop insurance carriers. Keep in mind, there have been only two carriers offering this type of coverage. Historically, other crop insurance policies would base the settlement on either a replacement cost or actual cash value depending on the carrier. Determining the right value using replacement cost or actual cash value is tricky due to factors such as market conditions, genetics, and demand for certain strains of cannabis.&...more

First Admitted Marijuana Insurance Carrier in the Nation Approved in California to Sell Pot Coverage

Golden Bear Insurance Co. will likely take a Big Bite out of Existing Non-Admitted Insurance Markets

Well, it finally happened with Golden Bear Insurance Company was approved by the California Department of insurance to offer coverage through an admitted insurance program for marijuana companies. This is a really big deal for those of us who specialize in marijuana insurance because historically, this line of insurance was offered only from "non-admitted carriers" specializing in "high" risk. This will be a bigger deal to the marijuana industry as they begin to benefit from either better pricing, coverage availability, and friendlier claims practices.

The primary difference between admitted versus non-admitted carriers is admitted are approved by the Department of Insurance through what is known as a rate filing. This means their policy forms, underwriting, and pricing are reviewed by a regulatory agency before approved and offered to the public. The non-admitted insurance market avoids this approval process leaving the cannabis business with fewer options.

According to our sources, Golden Be...more

Insurance Carriers Needing Assistance with Due Diligence Process for Offering Cannabis Coverage

With California around the corner, there are many insurance carriers contemplating or conducting analysis if they should start offering cannabis insurance to this fast growing industry. These insurance carriers might be admitted or non-admitted insurance companies seeking valid and credible information with structuring a cannabis insurance program through the right partners.

Insurance company executives, attorneys, actuaries, or other parties representing their respective interests actively conducting due diligence may want to contact us through the Expert Calling Network for a confidential consultation. Greenpoint Insurance Advisors, LLC is a retail insurance broker specializing in cannabis insurance since 2009. We've worked with hundreds of licensees in the areas of insurance procurement and risk management.

Important considerations if you're an insurance carrier:

- What types of risk should the insurance carrier consider?

- What product distribution channels should I use or avoid?

- Coverage analysis

- Other variables to consider known and unknown

- Contractual forms considerations

- Exposure analysis: liability, propert

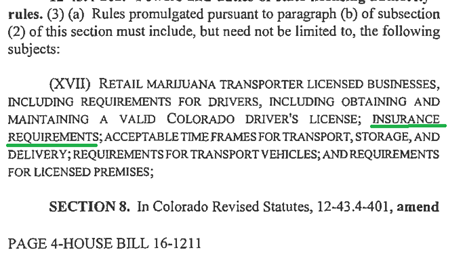

Insurance Requirements for Medical and Recreational Marijuana Transporter

Colorado Law Now Requires Marijuana Transporters be Licensed to Move Product

©2017 Greenpoint Insurance Advisors, LLCRecently, Colorado House Bill 16-1211 was signed into law requiring medical and recreational marijuana transporters to hold a state issued licensed. Using company vehicles, these businesses provide transportation of cannabis product from licensees and may offer the ability to store product at their business location or distribution point.

Colorado House Bill 16-1211 Marijuana Transporter Insurance[/caption]As a condition of their license, a transporter must have insurance. The law is silent as to the type of insurance, but in our opinion the purchase of commercial automobile insurance would be a minimum requirement with possibly commercial liability and property insurance particularly if the licensee maintains a storage or distribution facility.

A question that should be raised is how will the cannabis product be insured or covered during transportation or storage? This will be a difficult issue to address through insurance as carriers offering commercial automobile or business property have avoided insuring the property of others when ...more

Question of the Week: My Insurance Agent or Broker is Forcing Me to Buy Marijuana Product Liability Insurance. Do I have a choice?

Are There Other Marijuana Insurance Companies that Offer Just Commercial Liability Insurance or Product Liability Insurance?

Yes!

This question was presented most recently when a cannabis grower needed commercial general liability only. They weren't interested in buying product liability insurance at the time due to cost constraints. The additional premium was close to $2,800 per year. Unfortunately, the retail insurance broker presented insurance quotes for two different insurance policies could not comprehend or consider this was beyond their budget. The insurance carrier and its representatives required that both policies be purchased as a condition of the sale.

If you need marijuana insurance that doesn't require you to buy commercial liability and product liability "packaged" together the good news is there are other marijuana approved insurance companies willing to offer you the single line of insurance.

Originally Posted on MarijuanaDispensaryInsurance.com

...more

What Insurance Companies may want to Consider before Insuring the Marijuana Industry

By J.B. Woods, Greenpoint Insurance Advisors, LLC © 2017 All Rights Reserved (This article was originally published in Trusted Choice of Colorado)

The most recent election captured the attention of the insurance industry when states like California, Nevada, Massachusetts, and Maine voted to legalize marijuana along with medical marijuana initiatives being approved in other states such as Florida, North Dakota, and Arkansas. Over half of the United States has some form of marijuana law. According to Arcview Market Research, the marijuana industry resulted in $6.7 billion in sales for 2016 and made it one of the fastest growing industries.1

With the amount of growth in the marijuana industry, most insurance brokers are inclined to believe that insurance companies would be eager to offer commercial products such as commercial liability, product liability, directors & officers, property, and workers compensation. This has not been the case, as insurance carriers have grappled with the notion of insuring a product that is federally illegal. The result has been disappointing, as insurance companies have eagerly entered, but then later exite...more

Greenpoint Insurance Advisors, LLC

Greenpoint Insurance Advisors, LLC